BLUE CAP’S SHARES

Our capital market listing brings SMEs, which have no access to the stock market themselves, and investors together. We use our shareholders’ capital to gear the business models of our portfolio companies towards long-term and sustainable success. Our shareholders share in the success of our portfolio companies through regular dividend distributions and the increased value of the entire Group.

Share price development

Blue Cap share performance

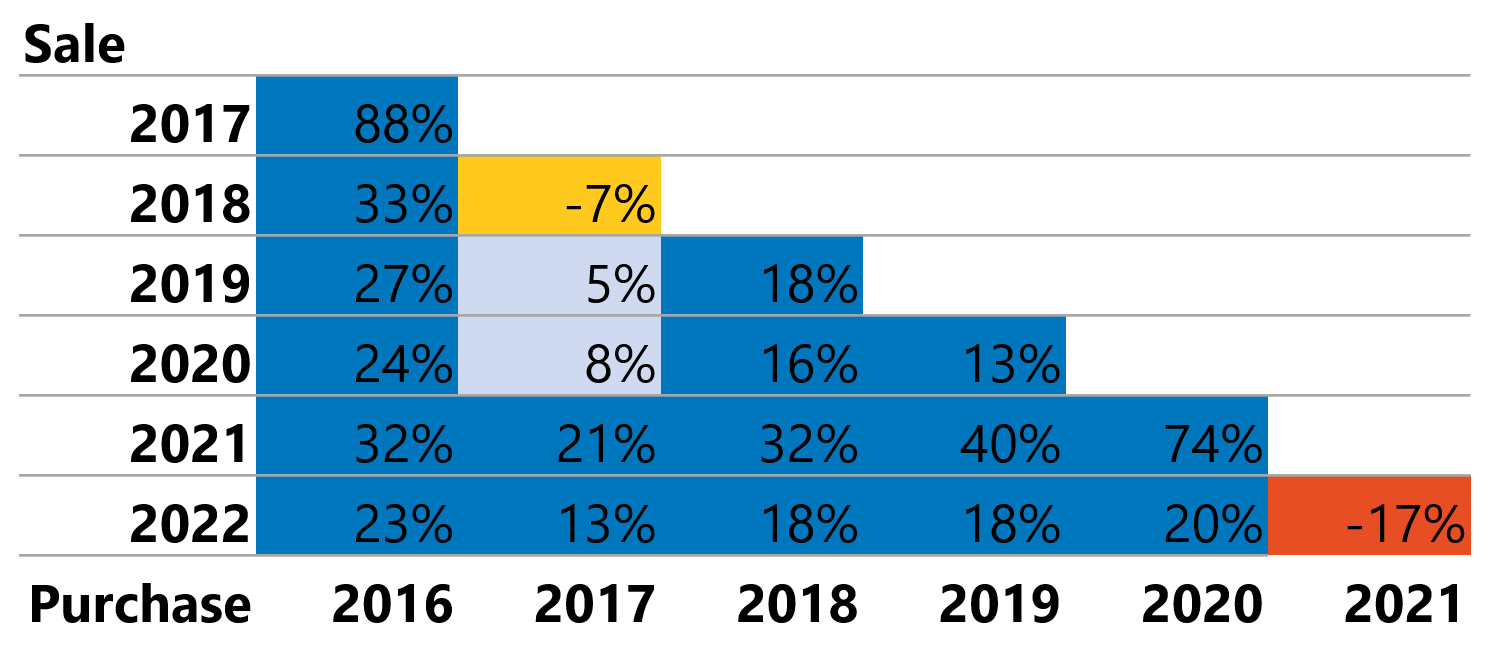

What returns did you achieve with your investment in Blue Cap shares since our first full financial year 2007?

The table below does only show some details. In order to see the data of the previous years, please click the download button below the picture.

Source: Frankfur Stock Exchange, Assumptions: reinvestment of dividends, buy and sell transactions at year end

Dividend policy

A stable and attractive dividend policy is part of Blue Cap's investment story. Shareholders should participate in the Group's operating performance with a regular base dividend. In addition, we generally aim to pay a special dividend if we have realized a successful exit with a good return on invested capital in the respective financial year.

Dividend

history

Dividend per share for financial

years 2017–2023

Scrip Dividend 2023

All information and documents relating to the scrip dividend are available via the following link.

Current shareholder

structure

As far as we know, the largest shareholder, with a stake of 27.1%, is PartnerFonds AG, whose liquidation was approved at an extraordinary general meeting of the company held in May 2020. As part of the liquidation process, the shares that PartnerFonds AG holds in Blue Cap AG are to be sold in the long term. There is currently no deadline by which this process is to have been completed.

In December 2022, PartnerFonds sold a first package to JotWe GmbH which holds 15.2% of the share capital.

As an anchor shareholder, Kreissparkasse Biberach holds 13.6% of the shares in the company as part of its long-term investment strategy.

Schüchl GmbH is another major shareholder with a long-term perspective and, according to its own information, holds 10.5% of the shares.

The remaining shares are in free float.

Key data

WKN: A0JM2M

ISIN: DE000A0JM2M1

Stock exchange symbol: B7E, B7E.DE (Reuters), B7E:GR (Bloomberg)

Type of share: Ordinary bearer shares

Share capital: EUR 4,486,283.00

Number of shares: 4,486,283

Trading venues: XETRA, Frankfurt, Munich, Stuttgart, Düsseldorf, Berlin, Tradegate

Stock exchange segments: Scale, m:access

Designated sponsor: BankM AG

Capital market partner: mwb fairtrade Wertpapierhandelsbank AG

Key share data

in EUR

| 2023 | 2022 | 2021 | |

|---|---|---|---|

| Number of shares (units) | 4,486,283 | 4,396,290 | 4,396,290 |

| Earnings per share | -4.02 | 2.78 | 1.24 |

| Dividend per share* | 0.65 | 0.90 | 0.85 |

| Dividend yield per share in % (based on year-end price) | 3.7 | 3.6 | 2.7 |

| Total distribution** in EUR million | 3.96 | 3.70 | |

| Annual high (XETRA) | 25.40 | 32.20 | 34.60 |

| Annual low (XETRA) | 14.70 | 18.50 | 18.05 |

| Year-end price (XETRA) | 17.70 | 24.80 | 31.00 |

| Market capitalisation at year-end in EUR million | 79.41 | 109.03 | 136.28 |

| Market capitalisation at year-end in EUR million Average daily turnover in no. of shares (all trading venues) | 1,251 | 1,037 | 3,446 |

*Subject to approval of the Annual General Meeting, expected in June 2024.

** Distribution amount 2023 related to capital increase in kind; of which dividend claims in the total amount of EUR 1,969,766.78 were exchanged for new Blue Cap shares.